wv estate tax return

Ad Access IRS Tax Forms. -- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall file with the Tax Commissioner on or before the date the federal estate tax return is required to be filed.

Property Tax Forms and Publications.

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

. 2023 Trend and Depreciation Trend and Percent Good Tables for Tax Year 2023. 2022 STC-1232-I Industrial Business Property Return. Your session has expired.

Payment of Additional Estate Taxes in WV. Office of Tax Appeals 1012 Kanawha Blvd. Tax engagement letter 2022.

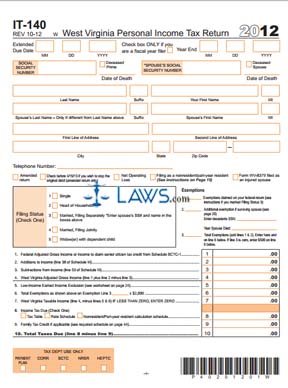

A full-year resident of West Virginia A full-year non-resident of West Virginia and have source income mark IT-140 as Nonresident and complete Column C of Schedule A. 1 A return. For 2000-2001 the exemption equivalent was 675000.

Department of the Treasury. Suite 300 Charleston WV 25301 Tel. A When no return required-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article.

Estate Tax Return Preparation in Wheeling WV. B Returns by personal representative-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall. Tax projection engagement letter.

The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Prior years are also listed in the appraisement booklet.

The sigNow extension was developed to help busy people like you to decrease the burden of putting your signature on legal forms. Tax Information and Assistance. State of West Virginia.

Department of Transportation State DOT on the roles and. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. 2022 STC-1232-I Supplemental Filing Instructions for the Industrial Property Return.

IT-140 West Virginia Personal Income Tax Return 2021. Tax Information and Assistance. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706.

Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. Start eSigning wv state tax department fiduciary estate tax return forms 2008 by means of tool and join the millions of satisfied clients whove already experienced the advantages of in-mail signing. 2020 tax return engagement letter.

A When no return required-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. 5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706 has been filed Department of the Treasury. Click Here to Start Over.

Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. Tax Return Preparation Financial Services Accounting Services. 4810 for Form 709 gift tax only.

Fillable-Forms Forms and Instructions Booklet Prior Year Forms. You will be automatically redirected to the home page or you may click below to return immediately. B Returns by personal representative.

Wvotawvgov Welcome to the Office of. Use the IT-140 form if you are. Website Directions More Info.

The schedule for determining whether an estate tax return is due can be found in the back of your appraisement booklet. Name A - Z Sponsored Links. Tax Information and Assistance.

Gift tax return engagement letter. YEARS WITH 304 233-5030. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

304 558-3333 or 800 982-8297. This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of. Zeno Pockl Lilly and Copeland AC.

304 558-3333 or 800 982-8297. B Returns by personal representative-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map.

2006 through 2008 2000000. 31 rows Florence KY 41042-2915. Complete Edit or Print Tax Forms Instantly.

B Returns by personal representative-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall. Agreement sets forth the agreement between the FHWA and the State of West Virginia. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

A When no return required-- No West Virginia estate tax return needs to be filed if the estate of the decedent is not subject to the tax imposed by this article. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

How To File Taxes For Free In 2022 Money

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

Free Form It 140 Personal Income Tax Return Free Legal Forms Laws Com

Will The Irs Extend The Tax Deadline In 2022 Marca

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

West Virginia Tax Forms And Instructions For 2021 Form It 140

/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022

Tax Returns For Deceased Taxpayers Canadian Tax Academy

Tax Form Templates 5 Free Examples Fill Customize Download

Understanding The 1065 Form Scalefactor

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Tax Form Templates 5 Free Examples Fill Customize Download

Oklahoma Tax Forms 2021 Printable State Ok 511 Form And Ok 511 Instructions