does draftkings provide tax forms

Players on online forums have showed concern about DraftKings W9 requests during withdrawals and through email. If you win any bet with super longshot odds where winnings are 300x more than the wager and you win 600 or more your winnings are reported to your home states tax office and to the IRS.

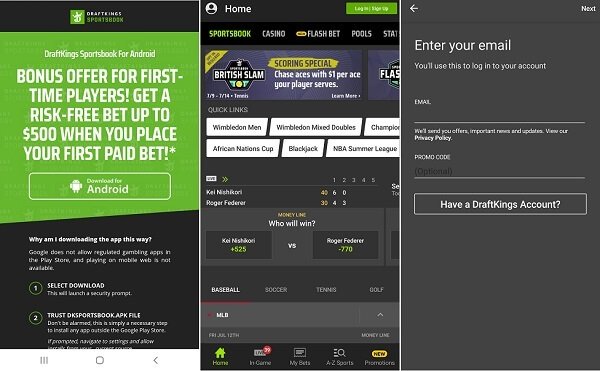

Draftkings Ny Mobile Sportsbook App Promo Review Launch Details

There is a 15 tax rate if you earn 600 or more betting on sports in Illinois.

. Does Coinbase Report to The IRS. The SSN helps DraftKings verify the identity of players and prepare informational reporting tax forms IRS Form 1099-Misc. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings.

For taxation purposes Sportsbook and Casino users are required to provide their SSN for taxation purposes related to a reportable event. Did you receive a tax form as a result of your daily fantasy sports play in 2015It may look like this or thisEven if you played and won and did not receive any tax forms there still may be an obligation to report and pay taxes on winnings. This is standard operating procedure for daily and traditional sports betting sites and is one of the requirements for DraftKings and sites like it to stay in business.

If you receive your winnings through PayPal the reporting form may be. DraftKings and FanDuel paid out more than 1 billion in prize money in 2015 and the IRS expects its share. Chances are if you havent.

If you have winnings of over 600 from any Daily Fantasy Sports site such as FanDuel or DraftKings you will likely receive a Form 1099-MISC with the amount shown on Box 3. Then if you win 1200 or more from a slot game your winnings are also reported to the same people. In our draftkings review we will provide you with and complete guide with everything that you need to know to answer how does draftkings work.

Todays post is more of a nuts-and-bolts explanation of how I personally calculated my net winnings and filled out the various tax forms associated with online gaming winnings. Information You Provide to Us. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year.

Fantasy sports winnings of at least 600 are reported to the IRS. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both yourself and the IRS a Form 1099 -MISC. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from.

In most states daily fantasy winnings of any amount are considered taxable income. Draftkings has this written regarding taxes. You can expect to receive your tax forms no later than February 28.

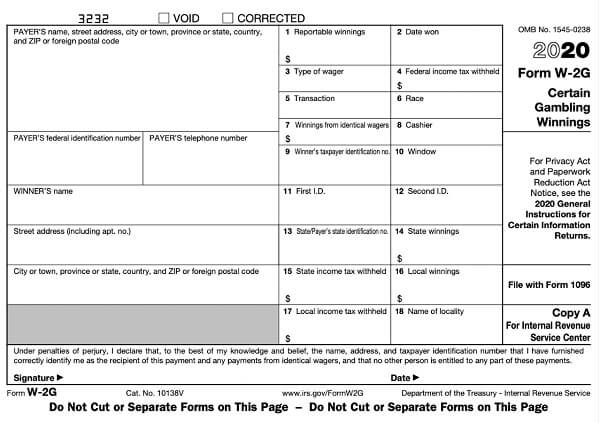

Reporting taxes from DFS play in 2015 is not. The information provided by the player on Form W-9 name social security number and address is used by DraftKings to populate IRS Form W-2G. For Oregon activity please contact the DraftKings Customer Support team as the information in this article may not apply to you.

Those sites should also send both you and the IRS a tax form if your winnings are 600 or. 41nsk7bcouwizm Draftkings Tax Form 1099 Where To Find It How To Fill 41nsk7bcouwizm Draftkings Sportsbook Nj Promo Code For 1 050 Bonus Offer Draftkings Sportsbook Review 20 Up To 1000 Deposit Bonus Draftkings Tax Form 1099 Where To Find It How To Fill. Does a W9 Form Mean You Owe Taxes.

TocThis is the first in a four-part series about paying taxes on daily fantasy sports. You do have to pay taxes on your Cumulative Net Profit from fantasy sports. This does happen but in limited circumstances.

Daily Fantasy Tax Reporting. IRS Targets Cryptocurrency Holders. Fantasy sports winnings of any size are considered taxable income and if you have a.

Dont panic DraftKings or any other daily fantasy site for that matter simply requests this information from all players so it is on file if they need to issue you a 1099 form. If this is the case you will report your DFS income shown in Box 3 on your 1099-Misc on line 8 on Schedule 1 of your individual tax form 1040. Many of you will play DFS casually and will report it as Other Income on your individual tax return.

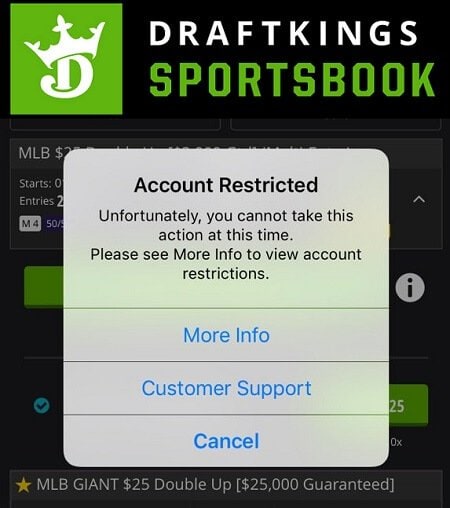

If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. If you won 50 of the bets but cant deduct losses and ended the year up 1k youd pay more of it. Why does anyone even gamble if you have to give all of the winnings away in taxes youd basically have to be correct on every bet without losing to come out ahead.

If you select to receive your winnings via e-wallets such as PayPal the reporting form may be a 1099 -K. This type of reporting is reported as hobby income. If you win 600 or more in a year your DFS site should send you a 1099-Misc tax form.

DraftKings customers are required to fill out an IRS Form W-9 W9 following a reportable win. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. Winnings From Online Sports Sites Are Taxable If you win money betting on sports from sites like DraftKings FanDuel or Bovada it is also taxable income.

Are there any DraftKings promo codes. Lets take a look at what Coinbase users should know about Coinbase tax documents and what forms you should provide accountants. The IRS International Revenue Services estimated that about 25 of the 450 billion tax gapor more than 11 billioncame from unreported.

If you make a net profit of over 600 for the year then you will be issued a 1099-MISC tax form. This is calculated by the approximate value as prizes won - entry feesbonuses. Email address phone number credit or debit card information and other billing information social security number tax documents and records of the products and Services you purchased obtained or considered.

DraftKings is required to issue 1099 tax forms to any player who has a cumulative net profit in excess of 600 for the calendar year.

Draftkings Sportsbook Review 20 Up To 1000 Deposit Bonus

Draftkings Faces Sec Subpoena And Irs Audit Gamblingspotlight

Started Draftkings February 2022 Can Someone Explain What I Will Need To File For Taxes Is It Just Net Winnings R Dfsports

Draftkings Sportsbook Nj Promo Code For 1 050 Bonus Offer

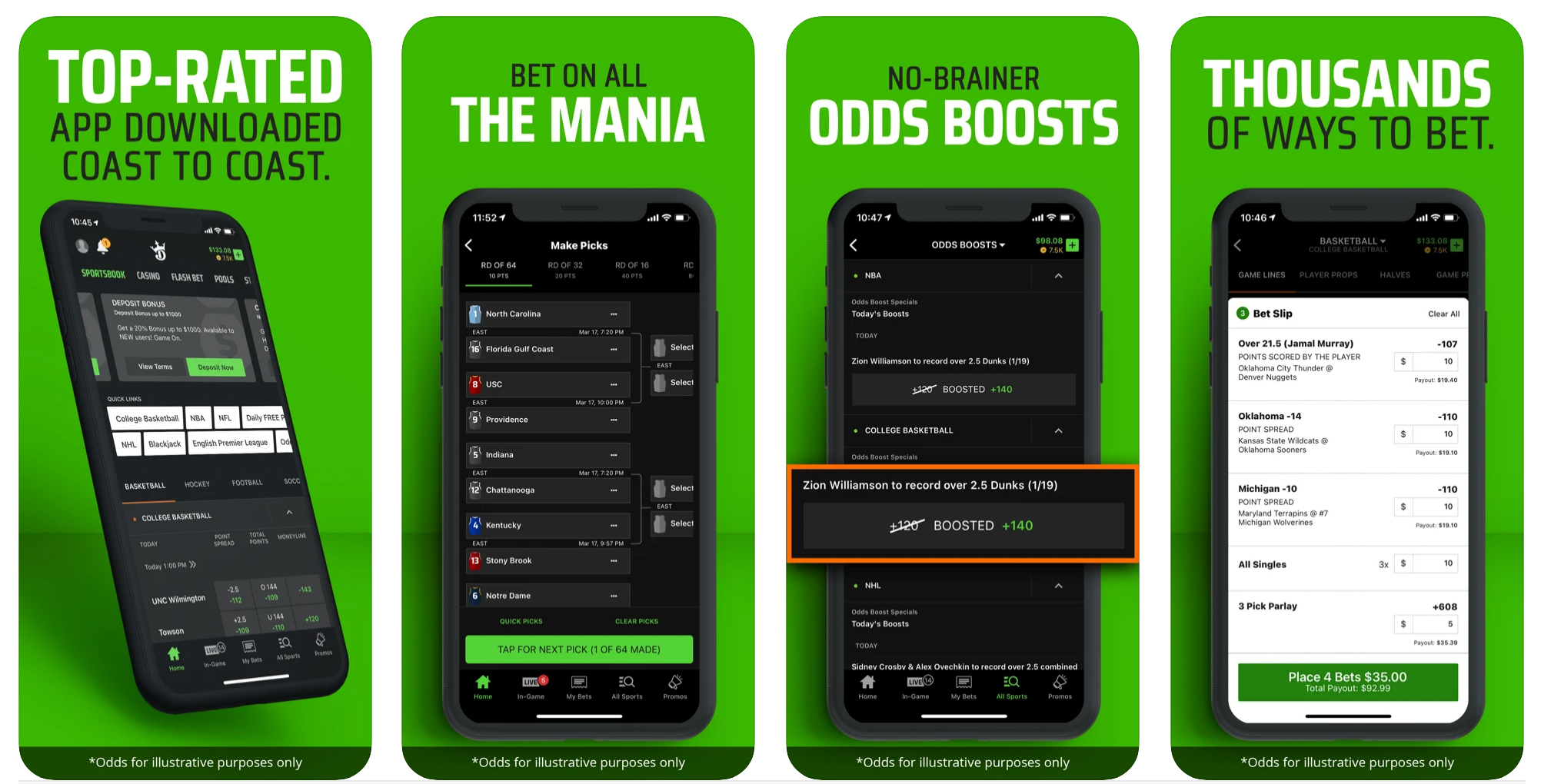

Draftkings Sportsbook Colorado A Phenomenal Sports Betting App

Restore Restricted Or Locked Draftkings Sportsbook Account

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Colorado Promo Code 1 050 Sportsbook Bonus

Draftkings Sportsbook App 1 000 Bonus Mobile Android Ios

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Settles Proxy Sports Betting Dispute In New Jersey

Draftkings Raises A Stink About Massachusetts Online Gaming Proposal Boston Business Journal

Draftkings Sportsbook And Casino Pa How To Play And Get 1 500 Free

Oregon Sports Betting Bet Online Draftkings Sportsbook

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Draftkings Colorado Promo Code 1 050 Sportsbook Bonus

Draftkings Sportsbook Is Offering No Juice Nfl Spreads Crossing Broad

Draftkings To Pay 325k In Class Action Settlement Top Class Actions